|

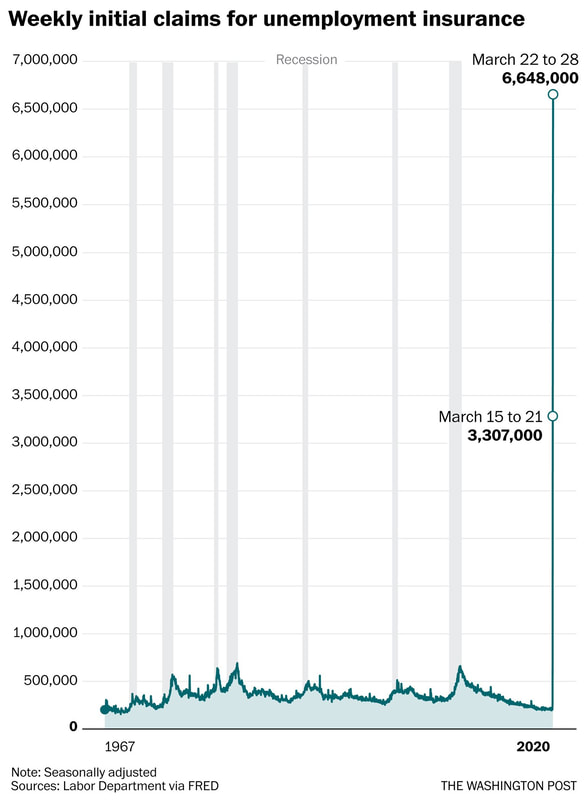

I think I can speak for most of us as real estate investors, the weekly reporting of jobless claims is causing a dark, burdensome lump to form in the pit of the stomach. The number has basically tripled for weeks in a row, topping 17 million, up from 6.6 the Thursday prior, up from 2 the week before that. This is nerve racking for any of us who rely on rent payments to cover the mortgage, but why do I feel so optimistic about this new strategy??

New construction may possibly be the one golden goose of the economy at the moment**. Why? Well, let me address the asterisk first. There is an enormous amount of new construction underway currently. Most of what is being built is class A apartments and townhomes. That has been the craze during the last 5-8 years of our economy, as people were making more and more money and many could afford to live in really nice places. We are not proposing that. Our idea is to build affordably priced housing, targeting the “middle market”. The forgotten middle market is what we are defining as individuals or families making between 61-115% of the Area Median Income. It is a surprisingly low amount of annual income, but not low enough to qualify for government assistance. They are effectively being forgotten by the housing market, and subsequently many of these earners cannot afford quality housing anywhere near their place of work. Our depart from the norm in construction is specifically addressing these earners with housing built to be affordable. We are able to build for less, therefore we do not have to charge as much for rent. Charging less for rent means that a wider tenant base will be willing and able to afford to occupy our communities. With higher occupancy, we hedge against market gyrations while providing higher equity multiples for our investors. People are losing jobs, but everyone needs a place to live. The first thing that happens during economic contraction is that people downsize. Storage does well during recession, so do mobile home/lowest income housing, but what happens to all of the middle market?? This is the answer and this is the new Golden Goose of this economy we are entering.

0 Comments

I was faced with a choice there after we were now at least five months into the deal.

Either walk and start over OR get a lawyer to just see if we can get something done. I asked one of my friends here in Chattanooga who he would recommend for legal advice and assistance. He gave me the name of a great lawyer. We started legal proceedings. We're actually getting ramped up to take it to court while I had to decide if I was willing to sue them and I was! I had that much in the deal and I was that engrossed in that I was willing to sue them to get this deal done. Another month passed and we were into June now and he calls me. I remember where we were we were in the parking lot, and he calls me and said they decided to settle they're going to close we're closing with cash tomorrow. I couldn't believe it! It was insane! We did not get all nine properties that we had under contract, but we did get two of them which ended up being five units total. It was supposed to be the the quad was supposed to be fully occupied and paying rent. There was one vacancy because the tenant had died previously at the hospital not in the unit. One of the other tenants was not paying any rent, and she let me know that she was not going to be paying rent. So we learned how to evict someonr within a month of taking ownership of property. We learned how badly that property have been treated. It had needed thousands of dollars worth of Renovations and work and things when we finally did it get that tenant out the One who is not going to pay rent? She destroyed the place tore the whole total of walls up flush newspaper down the toilet kick the doors in it needed a lot of work. The building was she did some damage to the building. It's the unit will to the unit to the building to because she flushed newspaper down and we had to do we had to do a lot of Plumbing major Plumbing issues the single family house the other one that we bought it was bacon. It had a lot of rot and things we didn't really get it inspected. We didn't really have a chance to but we got a really good deal on it. So I there was no way I was going to pass it up. I'll send done there was way more rot and way more work that went into it than we use. Counting forever and we still stayed in budget and we still stayed pretty close to our budget regardless, even even though all that happened what ended up happening with this whole portfolio December 6 months actually almost to the day six months after we closed on all five units. We refinance the quad it was fully leased and we got the Cash out refinance. We're able to pull a hundred and fifty five thousand dollars out of the Quad which paid off about 6065 percent of the money back to the investors our house got finished in the last two months. It has been rented. Our new renters are loving the place. They're paying rent. We're able to rent it out for much higher than what it was rented for our refinance on that. One is well under way we expect everyone will be paid out in full. We have a quad that is castling $2,000 though. I guess the whole portfolio is Cash flowing about $2,000 a month of both deals. Also put cash in our pocket and gave us two lines of credit with which to do other deals and we're rolling forward. We have more under contract. We're going to look at more it All started with that very first deal. So it's definitely possible to buy property with no money takes a lot of work. And as you just heard in this video, it was not easy. It's a lot easier to have money but it's possible and I would encourage you just to jump in with both feet. Maybe even die then if you're if you're trying to get into this, this was our first deal and how we get started. Thanks for watching. How do you buy real estate with no money and no job? Specifically, $350,000 worth of real estate with no money and no job.

We always tell this story over and over again with friends, family and at networking events. So we wanted to share with our viewers how we bought $350,000 worth of real estate with no money and no job. So how did it happen? Well, John heard about wholesaling back in the middle of 2018 and he thought it would be a good way to get into real estate. He worked for nine months on his first wholesale deal... getting it under contract, driving out to show it to people, and marketing it. Finally, he got it sold nine months later and made a couple thousand dollars, so not a whole lot of money. But what he did with that money is the important point to key in on. John used that money as an earnest deposit on a portfolio of properties. We found these properties by writing letters. We wrote letters and got them under contract and went about trying to figure out how I was going to buy $785,000 worth of real estate with no money and no job. So like any rational person would do, we started exploring all avenues. We went about finding any creative way so I could to purchase this portfolio. We started off by with my friends and family. We went through our contact list went through our contact list. We made a list of anybody that we knew and had any decent relationship with whether they have money or not. We started talking to them to see if they'd be interested in partnering and investing in the portfolio. We probably asked two dozen people if they wanted to invest in this first deal of ours and got twenty one "No's" but we got three yes's and that was all it took. All it took was 3 yes's to piece $170,000 together. We structured it as a loan. We didn't sell Equity or anything. I didn't really include much rehab budget in there. I was just trying to get what we could get. We had $170,000, which was supposed to be the down payment for the whole $780,000 package. We went to Banks started loan process. We found a bank that was so willing to do it for us, almost too eager it seemed, to start going about the process. While we finished raising all the money, we told them we had it all and that we were ready to close. The Problem.... The loan was declined 5 days before we are supposed to close in April, but nonetheless I got up the next morning and I got on the computer. I called every single hard money lender on the Bigger Pockets website. We talk to a bunch of people. I learned a whole lot about hard money lending. Connected with someone in Texas at a company that turned out that he was the son of the seller who is living in Florida. I thought it was serendipitous that he was going to help us get this this deal and was trying to help us close his Mom's property. Well, it turned out that he was not as transparent as we thought. He was not submitting our loan requests. He was not communicating with us, rather he was talking to his mother convincing her out of doing the deal with us. All said and done a month later, she tried walking from the deal, even though we were trying to close with a bank when she denied the appraiser and then cash which she refused to sign. I was faced with a choice there after we were now at least five months into this deal. Hmm either walk and start over or get a lawyer and just see if we can get something done. We have Part 2 coming tomorrow Check out our video of this by clicking here I'm going to talk about Partnerships real quick. So I have learned in this business that working together with other professionals is the BEST way to achieve any goal that you're going after. I definitely don't know everything, and rather than learn and master every facet of this business. I would rather share part of a deal with those who can do what I can't. I would rather leverage their skills. The net result is more deals for everyone.

As an example. I'm working on a deal right now with someone who reached out to me about investing here in Chattanooga. He really wanted to get into a deal in this market even though he doesn't live here. He also doesn't have a lot of experience investing in real estate and thought that we could partner together. It just so happened that I had a deal in my sights that fit what he's looking for the best part about it is that I was about to pass on it because it's not exactly what I want to do. So because of this us partnering together, I believe that we are going to partner on this deal that I otherwise would have passed on and it allows him to do deal that he never would have been able to do by himself. The net result is each of us does end up with a smaller portion of the deal, but if we both get to be part of a deal that we would never have done otherwise, I would say it's a net positive thing. I'm not saying that all Partnerships are good thing. Of course just like anything else in this business you have to do your due diligence. You have to trust who you're going to work with. You have to bring something to the table. You can't expect to jump into a partnership and bring nothing to the table. So whether that is the funds or the knowledge or you bring a deal or you bring a professional like attorney or real estate agent, or maybe you just bring expertise. You have to bring something to the table in order for it to be a meaningful partnership. There are a million different ways to partner and structuring it is just as simple as having a conversation with the person you are wanting to do the deal with. Maybe they bring all the money and they want 90% of the deal. Well, if all you have to bring them is a solid deal and being the boots on the ground is ten percent of the deal worth that to you. Maybe, maybe not. I don't know, but it would be a good way to get into a partnership. Having money is definitely not a requirement when you're going to partner on a deal Partnerships can be really powerful way to get more done than you would otherwise be able to do yourself. Money is not a requirement to get started in real estate, but you do need to bring something to the table. Like I said, whatever your specialty is knowledge, boots-on-the-ground, relationships. I would definitely explore getting started with real estate by forming a partnership with someone that you know. I wanted to talk briefly about some important, but scary sounding concepts. If you have entered into the commercial real estate world at all, then you know all about what a cap rate is and what it means for valuation of a commercial asset.

If you have not entered into the commercial real estate world and would like to or at least want to know a little bit more about it... Cap stands for Capitalization Rate and as complex as it sounds, it's pretty simple. This means it is the un-leveraged return-on-investment. The way you find out what the cap rate is by knowing the net operating income for the the amount of money the property is making - all of the expenses except for your mortgage. So you divide the Net Operating Income by the total purchase price. For example, if you have a million dollar property that makes $100,000 after expenses, but before your interest for bank payment, that would be a 10 cap because the un-leveraged rate of return is 10% of that. However, what gets confusing is it's actually a way to Value various properties. So a broker may come to you and say you know broker may come to you and say there's a property and it's trading for an eight cap. That means that whatever the purchase price of the may not even tell you what the purchase price is. They expect you to figure it out with a little calculation. Whatever the Net Operating Income is divided by 8 percent, that will give you the purchase price. That is a little foray into commercial real estate. A lot of people are talking right now about how cap rates are compressed. That means that people are buying commercial real estate for a lower cap rate, which sounds like a good thing, right? The cap rate is going down, but because of that calculation, the price is going up exponentially, not just as a factor of one to one. It's a multiple. The lower the cap rate, the way higher the price is going and that's what's happening right now. There's a lot of money out in our economy right now where a lot of commercial real estate is trading hands and the price is going up dramatically. So that's what they mean when they say the Cap Rate is compressing whereas things used to trade for 9-10 caps today. Those same assets are trading for 6 to 7, or 5-6, and in some markets like San Francisco and New York things are trading as low as 3-4, which means they are very expensive and not producing a great return. This doesn't mean that real estate is not a great investment still, it's all about buying a good deal and they're still out there. Just got to find them.  We want to talk to you about fitness, did you work out today? I just worked out actually. I was feeling groggy and sluggish and I realized I hadn't worked out today. So we took a pause on our filming in the studio and I did a quick little workout. During my workout I did dumbbell cleans, press thrusters, kettlebell cleans and burpees. I also did the ab wheel and medicine ball Russian twist. I basically only had ten minutes and three pieces of equipment and graciously lent to me by James, our marketing guy! So I just did everything I could think of. The reason we are wanting to talk about fitness is because it's really important that you get your workout in whether it is a 10-minute workout, quick hardcore to get the blood flowing. Going out and going for a hike or going canoeing or taking your dogs for a walk. Whatever it needs to be try to make it 30 minutes and just try to get out and do something, get the blood flowing and that's really what it's all about. Maybe we want to perform at our highest level. I mean, we're Real Estate Investors and you got to be pretty smart to be in the game. We want to be top performers and that means that our minds need to be active our bodies need to be active and we need to be using oxygen efficiently and effectively. As well as be healthy and that includes the foods we put into our body. Like us, Real Estate Investors, we don't normally just sit behind the desk all day. We are behind the desk. We may be walking our dogs, making check lists for our current properties. We will be out driving for dollars, walking through houses, meeting with contractors, meeting with potential investors. Whatever it may be, our day is never the same. It’s important for us to have our morning routine and our workouts in the morning so we can guarantee an energized and focused day! Crystal and I challenge you to workout out for 30 minutes everyday! Again, whether it is walking the dogs or hiking or whatever 30 minutes of working out means to you. Just go get it done. Be sure to share your experience and that you got it done! See our video by clicking here

Today I want to talk about something that's very near and dear to my heart, Real Estate Syndication. I know, that word sounds crazy and complicated but it really isn't. So, what is syndication? Well, the word syndication actually just means a pooling of resources and ideas to get a goal done. In real estate it means people pulling leadership skills and resources to purchase an investment property that is bigger than an individual may be able to do themselves.

There are a lot of people doing syndication right now. Some of the big ones you may have heard of are Grant Cardone and Joe Fairless. They're really out there right now talking about raising private money and they buy commercial assets and operate them using other people's money to provide a stable return. Why did we, Bugay Investments Group get into syndication? It's like that adage, “the end result is greater than the sum of its parts.” This is so true with syndication, you can get more done by pooling funds and resources, ideas and knowledge together. So we got into syndication because a) we are able to provide a stable return that beats the stock market for our investors and b) to be able to achieve greater returns than we would be able to do by ourselves. Our very first deal was a syndication. We raised private money to buy two properties and we will continue to do syndication on all of our deals from here on out. I love being able to provide huge returns to investors and I love how happy I make them with the checks they get back from us. As well as being able to grow our business quicker than doing it ourselves. What are the different ways to structure a syndication? It encompasses a lot of different ways to do the same thing more or less. There's two big main ways of structuring it. One is by selling equity or selling ownership in the company which owns the asset. You can think of that kind of like the stock market when you buy a share of stock you actually own a fractional piece of the company. The second way to structure it is through debt. You can think of this kind of like the bank except the private lenders are essentially the bank. They lend the money for a set rate of return and they will get their money back. No matter what happens if the syndicators failed to pay, the investors have the right to foreclose on the property and take ownership. Now going one way or the other it can get very complicated. I'm going to preface this by saying I'm not giving any legal advice, you need to consult your SEC attorney before you proceed down this path any further. This is for educational purposes only. Typically, selling equity in a company is for the bigger deals. It is tied to the performance of the asset more so than by raising money through debt. Debt is a very good way to get smaller deals done and once you get into the larger numbers, it can make more sense to sell equity. Equity tends to be a longer-term hold whereas debt can be short term. Those are two different ways you can Syndicate a deal to raise the money needed to purchase real estate. As a recap a syndication is a way to leverage people's resources and knowledge to get more done. It can be great for both the operator, the operation company and the private investors as it will beat out typically any other investment there is right now, especially the stock market. That’s what syndication is in a nutshell. This is a question that Crystal and I get asked often. I am going to try to keep it brief, but we are going to cover a lot here. How do you find and decide what your first Real Estate purchase is going to be?

When buying your very first single-family investment property, the first thing you want to do is figure out what your angle is. What is your strategy? You need to determine how you're going to move forward. There are three basic strategies you can choose for a single-family investment property:

Let's start with the fix and flip method. There are a couple of little easy rules I'm going to talk about to help you understand what you need to be doing for the flip. We're going to talk about a rule called the seventy percent Rule. Basically, what that means is you need to be all into your flip project for 70% of the ARV. That means, purchase and rehab. The purchase and rehab have to equal 70% of the ARV. The reason is that you need 30% for yourself for tax, any overages, and contingencies that may ultimately come up during your repair process. The way to figure your offer is to find the ARV using Comparable properties in the neighborhood. Then you will figure out what your rehab budget is going to be. This is what your equation will look like: ARV X 70% - Rehab = Offering Price Ex: 100,000 X 70% - 20,000 = $50,000 The second method I want to talk about is the buy and hold method. This is straight-up buying the rental property and renting it out. There is a rule that most people use, it’s called the 1% rule. What that means is the gross monthly rent should be One percent of the total purchase price. If it is, that will cover most mortgages and insurance while typically put one to three hundred dollars profit in your pocket. So what exactly does that look like if you have a hundred thousand dollar house? The rent should be $1,000 per month. If it is, there's a good likelihood that you're going to be making money. There are other factors that can play into your net profit, like insurance and location. Typically, however, it’s a pretty sound rule. The third strategy that I want to talk about is the BRRRR strategy and that buys, rehab, rent, refinance, repeat. Basically, it's a hybrid of the Fix and Flip and the Buy and Holds strategies. You're going to buy a property that needs to be rehabbed and you should use that 70% rule we talked about above. ARV X 70% - Rehab = Offering Price. Once you have finished the rehab process, instead of selling you will rent it out. Make sure when you decide the rental rate you are getting the 1% rule. Your ARV is $120,000 you want to try to get $1,200/mn in rent. Once the property is rented out the plan is to Refinance. This is called a Cash-Out Refinance. You're basically putting a mortgage on it, pulling the extra cash out, paying off the loan you used to purchase the property and rolling the cash into another deal. Crystal and I have completed the BRRRR strategy on two properties with great success. One tip from us: you have to be confident in your ARV estimate. Your refinance and rehab depends on the comps you pulled. The more practice you get with pulling comps and deciding the ARV on the property the better you will become at it. Crystal and I love this strategy and will continue to use this strategy in the years to come. We hope this was helpful and gives you the confidence to go make your first deal. Drop us a question in the comments below. We will make a video or blog post to answer your question! I will be a millionaire. I mean, I want to be worth a hundred million dollars been my goal for years and years. It's also a goal how many of us actually want to be in this seven-figure club though. Like most of us want to be there want to be rich they want to be millionaires. But what I want to talk about is what that actually means as far as like

Day-to-day life because I think that most people just see the rich as though they can just go on shopping sprees and vacations and do whatever they want to whenever they want to without a care in the world. And that's not true. That's not true at all. The only difference between the wealthy and average people is the way that they view money and wealthy people live within their means and whether they mean is you know going on vacations every other week or so or whether it's just able to make it without having to go in debt. The wealthy people live within their means, it's really the biggest thing. It really boils down to the things you do day-to-day for yourself to create wealth and long-term Financial Independence because that's really what we're all after investing. All the money that you can Into Cash flowing assets and whether it's business or real estate or stocks and bonds or people startups. It's investing. It's really important that you have the wealth-building mindset and we did a whole video on what that means versus the consumer mindset and to build wealth for yourself. It is super important. Ain't that you start changing your mindset into that wealth creation that wealth Max. Money is tool money is not for your pleasure money is for making more money and creating a life for yourself and you have to start viewing money differently with the walls building mindset. You can't sit there and you know a lot of the times we've heard growing up that money doesn't grow on trees or wait can't for that or you know just to get it negative talk about money. And if you have a negative talk about money, you're either going to be saving your money for a rainy day and then you're waiting for that rainy day to happen. So that rainy day happens or you're just going to be like I have the money to do it. Now. I'm going to go ahead and just blow my money now because I have it. I'm going to enjoy it but then you're stuck in the consumer mindset and you're not going to get out and so you really need to readjust your thoughts about money. I love Scott trench is one of the most impactful quotes from the book. He talks about everyone's heard. The Saying A Penny saved is a penny earned and Scott trench says that that's not true. Actually a penny saved is worth one point three pennies earned. Depending on your tax bracket. The money that you save is actually you've already paid tax on it. It's already yours versus the money you earn your yet to pay tax on so that when you're just getting started is going to be one of the biggest mindset shifts you can make is spend your money very wisely because it is the tool that will set you free. Another tip is sort of cliche. Say but really get outside of your comfort zone. I mean, if you're not happy with where you get comfortable being uncomfortable go to networking groups. Go listen to speakers. Listen to podcasts like do everything. You can get uncomfortable. I actually remember when we first moved here you found a real estate group that meets every fourth Thursday or something and you're like I'm going to go and I was like have fun. I'm staying at home. And because I was just like very uncomfortable. I didn't want to go out and meet new people and just kind of scared then he went by himself and he came back. He was I oh my gosh, I was so great and then we went to go to another one and then that ended up like bombing or something like they didn't show up and or maybe we just didn't see them, but we ended up meeting at a different table with another realtor and talking with her and then like now we go regularly and we know most of the people there so get out of your comfort zone. It'll help you, in the long run, something else that you need to do focus on self-improvement focus on yourself. You are the one that is going to do this. You need to give yourself the tools to be able to do it. No one's going to do it for you. You've got to actually you've got to make the change and you have to learn what you need to sew. Start reading start listening start watching YouTube videos. This is a great one. If you need to also start budgeting start finding out where you're spending money. Where can you stop spending money? And then instead of saying like I can't afford it start saying, how do I afford it? That's great. That word is so powerful. It's actually psychological. Actually studies have shown that the word if you just change your mindset by asking yourself how they've done functional MRI scans of the brain of people who ask how versus people who say I can't and the person who says I can't afford it. I can't do that. I don't know how to do that their brain shuts off. Its it is the end of the sequence in their brain, but for those people who ask how can I afford it? How can I learn to do that? How opens up possibilities their brains immediately start trying to solve the problem something else you can do to add to your financial Independence is add multiple streams of income and I know you've probably heard it before, you know, the average millionaire has seven streams of income. Income and but honestly though that's true. If you are reliant on your paycheck, which comes from your time that you spent working you the amount of money you can make is tied to the amount of time you have to spend on it and there's a finite amount of time we have each day each week each year, too. Make money in that way. Well, I'm not just that people say that they go to college to get a secured job, but it's not really secure. You can lose your job and need alike you make one wrong mistake or the company starts to go bankrupt. They're going to make cuts and you could be one of the first ones to be let go you think it's secure you think I've got a paycheck coming in every week. But really it's not secure. Multiple streams of income whether passive or semi-passive. That is the only way you're going to be able to Achieve Financial Freedom early in life. We chose real estate it appealed to us, but it's by no means the only way to do it. You people have become very very wealthy in the stock market people have become very very wealthy with startup investing. In start-up businesses apps and we won't we won't go into detail. But I mean we're working on more like he is working on two other ideas for our business that is completely not real estate the newsreels. So we're working on our second and third sources of income as we speak. The last one. I really want to talk about I hate the model of work 40 years during the best years of your life. Life and hopefully have saved enough money for retirement by 65 and live a happy retirement and old age somewhere on some beach. I think that sucks. I hate that. I would rather work really hard right now than take a micro retirement. And what I mean is a year two-three to do something very different with my life and then come back to work doing again things. I enjoy but taking time off coming back. There is no need to work in the best years of your life away. For the hopes that you've saved enough money to live old age in some secluded area by your you know at the end of your life, I'd rather break it up, you know able to take time to go to the things that you want to do while you're still young actually. I've seen a lot of people posting about that. This is why you need to Vacation while you're young because there was a couple who is photographed on a gondola. Something about an Italy and they're going down a little stream and it's an older couple the retired couple probably and they're like passed out in the boat. So they are tired so they missed an experience because they were sleeping on the boat. So do it while you're if you've built the life yourself that you enjoy why I stopped. I stopped working. I mean, I love what we do. It's so stressful and it's so much work and I love it to death. It's great. I say it's taking actually like six months break and then going back to work and taking another six-month break like two years later. Definitely. So I hope that some of what we have talked about will help that mind shift because that's the most important thing is to get your mind right before you get your life. Right? So we mind right before you get your life, right? So those are just some of the things that we have been working on are still working on real and we just wanted to share with you. Thank you guys for watching. We are Bugay Investment Group. Hey guys, so we're going to tell a funny story today. It's one that probably scares a lot of new landlords, but truthfully it's not that scary and it ours ended up being hilarious everyone. We tell the store to laugh. So we're going to talk about our first eviction. Okay, learning laughs like and how horribly it went. It was just couldn't have gone worse. I don't

I'm sure it probably could have oh, I'm just glad I didn't so when we bought our quad we inherited one of the tenants there. I'm not going to give her name. I walk up to introduce myself after we close and she informs me that she had not paid rent in a month and had no plans to in the coming. Because she was out of a job and she had just gotten hurt and from the second we met her. She said hi, my name is and this is why I can't pay rent. It was instant excuses, you know the whole it was hilarious being the, you know, do it ourselves that we thought we were I we thought why not just try and get this eviction done ourselves. So we Google how to evict and I actually call My friends who's a property manager in Murfreesboro sounded simple now just go to the courthouse and file the eviction. So I did I went down there and the lady at the desk told me that I needed to give 30 day notice. So I said, okay, I'll give her a 30-day notice. And I went and I gave her a 30-day notice first. You you gave her like a 14-day notice. That's right. That's right. I gave her a 14-day notice this time at the property manager from Murfreesboro said you could affect them in two weeks. Just give them a 14-day notice. That's right. Yeah, so I gave her a 14-day notice. Yeah, and then he went to the courthouse and they said I needed a 30-day notice. So now we are you know. 44 days until she has to leave. I think we ended up did we do 30 days on top of the 14 or did we do yeah, we were required to do 30 days on top of the 14 we were trying to do it ourselves. We were stuck with a tenant for four months 44 days who was not paying rent. Well, and and so then you also called the lawyer because we were like well, I feel like we could get her. Out sooner so he called the lawyer and the lawyer is like well, yeah we can we can do this this and this how many days could he have gotten her out three days. There was a three day turnaround if I had just gone to the lawyer first. Yeah, and it would have cost me 200 dollars give or take but he he could have gotten her out in three days. So we weren't able to do anything because we had already given her the notice and then the other notice. Earth BL now of say giving her legal right to the place now 30 extra days. So so if you have to do an eviction contact a real estate attorney, or if you already have one contact them and ask them to have them do it and it's so much easier to do it. Yes. I think the worst part of the whole process was the the what she did she definitely Lee calls them the walls and flush things down the toilet that should not have been there for a really funny video check out our Instagram account and you can see the plumbing accident the plumbing issues that we had because of this tenant mind. You wouldn't have had that had we gotten her out in three days. Probably she had 40 days to Stew on the fact that she didn't know she had no place to go so, you know, Data for him, but she wasn't playing by the rules. So so anyway, we learned our lesson next time if we have to do another eviction. Hopefully we don't ever have to do another one but it's inevitable in the real estate world, right? And if we ever have to do another one, we're going to call our lawyer up and have him deal with it. Let's just talk about some of the things we're doing to make sure we don't have to evict in the future and we're trying to vet our tenants. Pretty well, we actually use a service called neighborly. It's included for free through the Telus app, which is who does our software our are the software we use for our property management. They provide free tenant screening the check all the things in the background. Really what I'm looking for is past evictions any type of property damage insane amounts of debt. That would just take away from their ability to pay rent are actually making money and enough money like over 2 times what the rent is but we also look at their past rental history not just for evictions. But how long have they been staying there? Do they apartment hop? So if they've been in one place for five years then absolutely come, you know, but if if they are alike. Ain't one year this apartment the next year the next year the next year. It's kind of like oh, you know, we're we won't be guaranteed that they're going to stay with us long term expect the same and you're also not going to be guaranteed that they'll take care of the property as well. Right? So I think screening is the biggest thing, you know will work with people on the credit score, you know for the most part. It's just big red flag. So we Watch out for and and we like to meet them, you know, when we which you do and you show the property you meet them and you see how their demeanor is now. And anybody that is going to be living in the premises. You need to be having them fill out the application as well. Yes, absolutely. So it's really it's not that scary. You know, don't don't let it hold you. React there's nothing. You can't figure out even if you don't know the answer go ask somebody. Yeah, even in eviction on your very first run. Don't worry about it. Not a big deal. So we thought that story was pretty funny and very relatable. Thank you guys for watching. We are Bugay Investment Group. |

AuthorJohn is the owner of Bugay Investments Group. He loves Real Estate Investing and wants to share his thoughts and knowledge with you! Archives

April 2020

Categories |

RSS Feed

RSS Feed